Collection of 2022 irs income tax brackets ~ 22 83550 to 178150. Income ranges for the tax brackets.

as we know it lately is being hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of the post I will discuss about 2022 Irs Income Tax Brackets The 2022 Projected US.

2022 irs income tax brackets

Collection of 2022 irs income tax brackets ~ The RATEucator calculates what is outlined here for you. The RATEucator calculates what is outlined here for you. The RATEucator calculates what is outlined here for you. The RATEucator calculates what is outlined here for you. 2022 Estimated Income Tax Rates and Standard Deductions. 2022 Estimated Income Tax Rates and Standard Deductions. 2022 Estimated Income Tax Rates and Standard Deductions. 2022 Estimated Income Tax Rates and Standard Deductions. Tax Brackets for 2020 2021 and 2022. Tax Brackets for 2020 2021 and 2022. Tax Brackets for 2020 2021 and 2022. Tax Brackets for 2020 2021 and 2022.

Projected 2022 tax rate bracket income ranges. Projected 2022 tax rate bracket income ranges. Projected 2022 tax rate bracket income ranges. Projected 2022 tax rate bracket income ranges. Bloomberg Tax Accounting has projected 2022 income ranges for each tax rate bracket. Bloomberg Tax Accounting has projected 2022 income ranges for each tax rate bracket. Bloomberg Tax Accounting has projected 2022 income ranges for each tax rate bracket. Bloomberg Tax Accounting has projected 2022 income ranges for each tax rate bracket. Unmarried Individuals other than Surviving Spouses and Heads of Households Projected 2022 Tax Rate Bracket. Unmarried Individuals other than Surviving Spouses and Heads of Households Projected 2022 Tax Rate Bracket. Unmarried Individuals other than Surviving Spouses and Heads of Households Projected 2022 Tax Rate Bracket. Unmarried Individuals other than Surviving Spouses and Heads of Households Projected 2022 Tax Rate Bracket.

Unmarried individuals other than surviving spouses and heads of households Projected 2022 Tax Rate Bracket Income Ranges. Unmarried individuals other than surviving spouses and heads of households Projected 2022 Tax Rate Bracket Income Ranges. Unmarried individuals other than surviving spouses and heads of households Projected 2022 Tax Rate Bracket Income Ranges. Unmarried individuals other than surviving spouses and heads of households Projected 2022 Tax Rate Bracket Income Ranges. 2022 Tax Returns are due on April 15 2023. 2022 Tax Returns are due on April 15 2023. 2022 Tax Returns are due on April 15 2023. 2022 Tax Returns are due on April 15 2023. 8365375 37 within BracketFor your personal Effective Tax Rate use the RATEucator Tool aboveKeep in mind you might be able to reduce your taxable income andor increase your nontaxable income and as a result fall into lower a tax bracket. 8365375 37 within BracketFor your personal Effective Tax Rate use the RATEucator Tool aboveKeep in mind you might be able to reduce your taxable income andor increase your nontaxable income and as a result fall into lower a tax bracket. 8365375 37 within BracketFor your personal Effective Tax Rate use the RATEucator Tool aboveKeep in mind you might be able to reduce your taxable income andor increase your nontaxable income and as a result fall into lower a tax bracket. 8365375 37 within BracketFor your personal Effective Tax Rate use the RATEucator Tool aboveKeep in mind you might be able to reduce your taxable income andor increase your nontaxable income and as a result fall into lower a tax bracket.

IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022. IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022. IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022. IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022. Married Filing Jointly and Surviving Spouses. Married Filing Jointly and Surviving Spouses. Married Filing Jointly and Surviving Spouses. Married Filing Jointly and Surviving Spouses. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022.

Irs 2022. Irs 2022. Irs 2022. Irs 2022. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below. 2021 Federal Taxable Income IRS Tax Brackets and Rates. 2021 Federal Taxable Income IRS Tax Brackets and Rates. 2021 Federal Taxable Income IRS Tax Brackets and Rates. 2021 Federal Taxable Income IRS Tax Brackets and Rates.

Rate brackets for other filing statuses are included in the full report. Rate brackets for other filing statuses are included in the full report. Rate brackets for other filing statuses are included in the full report. Rate brackets for other filing statuses are included in the full report. And 37 647850 or more. And 37 647850 or more. And 37 647850 or more. And 37 647850 or more. Threshold amounts for the Section 199A qualified business income deduction which for 2022 are projected to be 340100 for joint filers and 170050 for single filers. Threshold amounts for the Section 199A qualified business income deduction which for 2022 are projected to be 340100 for joint filers and 170050 for single filers. Threshold amounts for the Section 199A qualified business income deduction which for 2022 are projected to be 340100 for joint filers and 170050 for single filers. Threshold amounts for the Section 199A qualified business income deduction which for 2022 are projected to be 340100 for joint filers and 170050 for single filers.

The IRS received 379 applications requesting over 70. The IRS received 379 applications requesting over 70. The IRS received 379 applications requesting over 70. The IRS received 379 applications requesting over 70. 10 0 to 20550. 10 0 to 20550. 10 0 to 20550. 10 0 to 20550. 37 647850 or more. 37 647850 or more. 37 647850 or more. 37 647850 or more.

Use the 2022 Tax Calculator to estimate 2022 Tax. Use the 2022 Tax Calculator to estimate 2022 Tax. Use the 2022 Tax Calculator to estimate 2022 Tax. Use the 2022 Tax Calculator to estimate 2022 Tax. See IRS taxable income thresholds for previous tax brackets for back taxes or future 2021 brackets. See IRS taxable income thresholds for previous tax brackets for back taxes or future 2021 brackets. See IRS taxable income thresholds for previous tax brackets for back taxes or future 2021 brackets. See IRS taxable income thresholds for previous tax brackets for back taxes or future 2021 brackets. An official website of the united states government looking for a few basics on the history and mission of the nations tax agency. An official website of the united states government looking for a few basics on the history and mission of the nations tax agency. An official website of the united states government looking for a few basics on the history and mission of the nations tax agency. An official website of the united states government looking for a few basics on the history and mission of the nations tax agency.

This law made significant changes to the us tax structure. This law made significant changes to the us tax structure. This law made significant changes to the us tax structure. This law made significant changes to the us tax structure. Then Taxable Rate within that threshold is. Then Taxable Rate within that threshold is. Then Taxable Rate within that threshold is. Then Taxable Rate within that threshold is. This page is being updated for Tax Year 2022. This page is being updated for Tax Year 2022. This page is being updated for Tax Year 2022. This page is being updated for Tax Year 2022.

In december 2017 the tax cuts and jobs act was passed in the united states. In december 2017 the tax cuts and jobs act was passed in the united states. In december 2017 the tax cuts and jobs act was passed in the united states. In december 2017 the tax cuts and jobs act was passed in the united states. Married Individuals Filling Joint Returns. Married Individuals Filling Joint Returns. Married Individuals Filling Joint Returns. Married Individuals Filling Joint Returns. Around 80 of filers fall into this catego. Around 80 of filers fall into this catego. Around 80 of filers fall into this catego. Around 80 of filers fall into this catego.

Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds. 12 20550 to 83550. 12 20550 to 83550. 12 20550 to 83550. 12 20550 to 83550. 35 431900 to 647850. 35 431900 to 647850. 35 431900 to 647850. 35 431900 to 647850.

Brackets Will Change If. Brackets Will Change If. Brackets Will Change If. Brackets Will Change If. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008. 32 340100 to 431900. 32 340100 to 431900. 32 340100 to 431900. 32 340100 to 431900.

IR-2021-200 October 12 2021 WASHINGTON The Internal Revenue Service recently awarded over 41 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation. IR-2021-200 October 12 2021 WASHINGTON The Internal Revenue Service recently awarded over 41 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation. IR-2021-200 October 12 2021 WASHINGTON The Internal Revenue Service recently awarded over 41 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation. IR-2021-200 October 12 2021 WASHINGTON The Internal Revenue Service recently awarded over 41 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation. The 2022 Projected US. The 2022 Projected US. The 2022 Projected US. The 2022 Projected US. Tax Rates and Brackets Tables for Tax Year 2020. Tax Rates and Brackets Tables for Tax Year 2020. Tax Rates and Brackets Tables for Tax Year 2020. Tax Rates and Brackets Tables for Tax Year 2020.

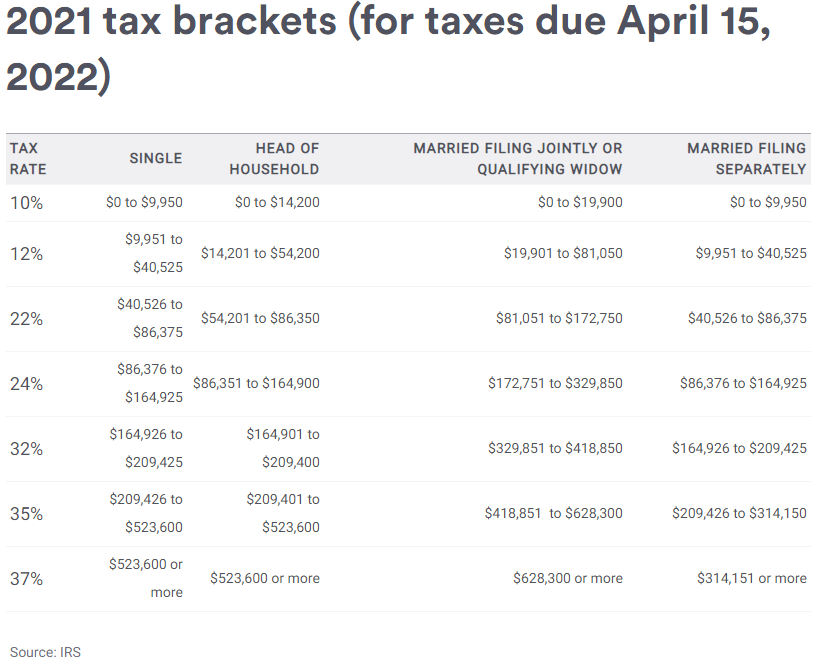

The 2022 Projected US. The 2022 Projected US. The 2022 Projected US. The 2022 Projected US. Below are the official 2021 IRS tax brackets. Below are the official 2021 IRS tax brackets. Below are the official 2021 IRS tax brackets. Below are the official 2021 IRS tax brackets. Individual Income Tax Rate Brackets. Individual Income Tax Rate Brackets. Individual Income Tax Rate Brackets. Individual Income Tax Rate Brackets.

10 0 to 20550. 10 0 to 20550. 10 0 to 20550. 10 0 to 20550. For example the 10 percent tax bracket applies to income up to 9950 for single filers in 2021 tax brackets whereas it was 9700 for 2020. For example the 10 percent tax bracket applies to income up to 9950 for single filers in 2021 tax brackets whereas it was 9700 for 2020. For example the 10 percent tax bracket applies to income up to 9950 for single filers in 2021 tax brackets whereas it was 9700 for 2020. For example the 10 percent tax bracket applies to income up to 9950 for single filers in 2021 tax brackets whereas it was 9700 for 2020. 22 83550 to 178150. 22 83550 to 178150. 22 83550 to 178150. 22 83550 to 178150.

35 431900 to 647850. 35 431900 to 647850. 35 431900 to 647850. 35 431900 to 647850. 10 0 to 10275. 10 0 to 10275. 10 0 to 10275. 10 0 to 10275. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors.

Gross income ceiling for corporations and partnerships to use the cash method of accounting which for 2022 is projected to remain 27000000. Gross income ceiling for corporations and partnerships to use the cash method of accounting which for 2022 is projected to remain 27000000. Gross income ceiling for corporations and partnerships to use the cash method of accounting which for 2022 is projected to remain 27000000. Gross income ceiling for corporations and partnerships to use the cash method of accounting which for 2022 is projected to remain 27000000. 32 340100 to 431900. 32 340100 to 431900. 32 340100 to 431900. 32 340100 to 431900. Federal tax brackets 2022 chart. Federal tax brackets 2022 chart. Federal tax brackets 2022 chart. Federal tax brackets 2022 chart.

24 178150 to 340100. 24 178150 to 340100. 24 178150 to 340100. 24 178150 to 340100. Bloomberg Tax Accounting has issued its projections for 2022 federal income tax rates and tables which provides a detailed and comprehensive projection of inflation-adjusted amounts in the tax code. Bloomberg Tax Accounting has issued its projections for 2022 federal income tax rates and tables which provides a detailed and comprehensive projection of inflation-adjusted amounts in the tax code. Bloomberg Tax Accounting has issued its projections for 2022 federal income tax rates and tables which provides a detailed and comprehensive projection of inflation-adjusted amounts in the tax code. Bloomberg Tax Accounting has issued its projections for 2022 federal income tax rates and tables which provides a detailed and comprehensive projection of inflation-adjusted amounts in the tax code. This year the IRS awarded grants to 34 TCE and 300 VITA applicants. This year the IRS awarded grants to 34 TCE and 300 VITA applicants. This year the IRS awarded grants to 34 TCE and 300 VITA applicants. This year the IRS awarded grants to 34 TCE and 300 VITA applicants.

Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. 24 178150 to 340100. 24 178150 to 340100. 24 178150 to 340100. 24 178150 to 340100. 12 20550 to 83550. 12 20550 to 83550. 12 20550 to 83550. 12 20550 to 83550.

Projected 2022 Tax Rate Bracket Income Ranges. Projected 2022 Tax Rate Bracket Income Ranges. Projected 2022 Tax Rate Bracket Income Ranges. Projected 2022 Tax Rate Bracket Income Ranges. Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. IRS Releases 2021 Tax Brackets. IRS Releases 2021 Tax Brackets. IRS Releases 2021 Tax Brackets. IRS Releases 2021 Tax Brackets.

2022 Federal Income Tax Rates. 2022 Federal Income Tax Rates. 2022 Federal Income Tax Rates. 2022 Federal Income Tax Rates. If Taxable Income is. If Taxable Income is. If Taxable Income is. If Taxable Income is.

2020 2021 Federal Income Tax Brackets And Tax Rates Ageras

Source Image @ www.ageras.com

2022 irs income tax brackets | 2020 2021 Federal Income Tax Brackets And Tax Rates Ageras

Collection of 2022 irs income tax brackets ~ The RATEucator calculates what is outlined here for you. The RATEucator calculates what is outlined here for you. The RATEucator calculates what is outlined here for you. 2022 Estimated Income Tax Rates and Standard Deductions. 2022 Estimated Income Tax Rates and Standard Deductions. 2022 Estimated Income Tax Rates and Standard Deductions. Tax Brackets for 2020 2021 and 2022. Tax Brackets for 2020 2021 and 2022. Tax Brackets for 2020 2021 and 2022.

Projected 2022 tax rate bracket income ranges. Projected 2022 tax rate bracket income ranges. Projected 2022 tax rate bracket income ranges. Bloomberg Tax Accounting has projected 2022 income ranges for each tax rate bracket. Bloomberg Tax Accounting has projected 2022 income ranges for each tax rate bracket. Bloomberg Tax Accounting has projected 2022 income ranges for each tax rate bracket. Unmarried Individuals other than Surviving Spouses and Heads of Households Projected 2022 Tax Rate Bracket. Unmarried Individuals other than Surviving Spouses and Heads of Households Projected 2022 Tax Rate Bracket. Unmarried Individuals other than Surviving Spouses and Heads of Households Projected 2022 Tax Rate Bracket.

Unmarried individuals other than surviving spouses and heads of households Projected 2022 Tax Rate Bracket Income Ranges. Unmarried individuals other than surviving spouses and heads of households Projected 2022 Tax Rate Bracket Income Ranges. Unmarried individuals other than surviving spouses and heads of households Projected 2022 Tax Rate Bracket Income Ranges. 2022 Tax Returns are due on April 15 2023. 2022 Tax Returns are due on April 15 2023. 2022 Tax Returns are due on April 15 2023. 8365375 37 within BracketFor your personal Effective Tax Rate use the RATEucator Tool aboveKeep in mind you might be able to reduce your taxable income andor increase your nontaxable income and as a result fall into lower a tax bracket. 8365375 37 within BracketFor your personal Effective Tax Rate use the RATEucator Tool aboveKeep in mind you might be able to reduce your taxable income andor increase your nontaxable income and as a result fall into lower a tax bracket. 8365375 37 within BracketFor your personal Effective Tax Rate use the RATEucator Tool aboveKeep in mind you might be able to reduce your taxable income andor increase your nontaxable income and as a result fall into lower a tax bracket.

IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022. IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022. IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022. Married Filing Jointly and Surviving Spouses. Married Filing Jointly and Surviving Spouses. Married Filing Jointly and Surviving Spouses. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022.

Irs 2022. Irs 2022. Irs 2022. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below. 2021 Federal Taxable Income IRS Tax Brackets and Rates. 2021 Federal Taxable Income IRS Tax Brackets and Rates. 2021 Federal Taxable Income IRS Tax Brackets and Rates.

Rate brackets for other filing statuses are included in the full report. Rate brackets for other filing statuses are included in the full report. Rate brackets for other filing statuses are included in the full report. And 37 647850 or more. And 37 647850 or more. And 37 647850 or more. Threshold amounts for the Section 199A qualified business income deduction which for 2022 are projected to be 340100 for joint filers and 170050 for single filers. Threshold amounts for the Section 199A qualified business income deduction which for 2022 are projected to be 340100 for joint filers and 170050 for single filers. Threshold amounts for the Section 199A qualified business income deduction which for 2022 are projected to be 340100 for joint filers and 170050 for single filers.

The IRS received 379 applications requesting over 70. The IRS received 379 applications requesting over 70. The IRS received 379 applications requesting over 70. 10 0 to 20550. 10 0 to 20550. 10 0 to 20550. 37 647850 or more. 37 647850 or more. 37 647850 or more.

Use the 2022 Tax Calculator to estimate 2022 Tax. Use the 2022 Tax Calculator to estimate 2022 Tax. Use the 2022 Tax Calculator to estimate 2022 Tax. See IRS taxable income thresholds for previous tax brackets for back taxes or future 2021 brackets. See IRS taxable income thresholds for previous tax brackets for back taxes or future 2021 brackets. See IRS taxable income thresholds for previous tax brackets for back taxes or future 2021 brackets. An official website of the united states government looking for a few basics on the history and mission of the nations tax agency. An official website of the united states government looking for a few basics on the history and mission of the nations tax agency. An official website of the united states government looking for a few basics on the history and mission of the nations tax agency.

This law made significant changes to the us tax structure. This law made significant changes to the us tax structure. This law made significant changes to the us tax structure. Then Taxable Rate within that threshold is. Then Taxable Rate within that threshold is. Then Taxable Rate within that threshold is. This page is being updated for Tax Year 2022. This page is being updated for Tax Year 2022. This page is being updated for Tax Year 2022.

In december 2017 the tax cuts and jobs act was passed in the united states. In december 2017 the tax cuts and jobs act was passed in the united states. In december 2017 the tax cuts and jobs act was passed in the united states. Married Individuals Filling Joint Returns. Married Individuals Filling Joint Returns. Married Individuals Filling Joint Returns. Around 80 of filers fall into this catego. Around 80 of filers fall into this catego. Around 80 of filers fall into this catego.

Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds. 12 20550 to 83550. 12 20550 to 83550. 12 20550 to 83550. 35 431900 to 647850. 35 431900 to 647850. 35 431900 to 647850.

Brackets Will Change If. Brackets Will Change If. Brackets Will Change If. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008. This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the Department of Labor announced the Consumer Price index is the highest since 2008. 32 340100 to 431900. 32 340100 to 431900. 32 340100 to 431900.

IR-2021-200 October 12 2021 WASHINGTON The Internal Revenue Service recently awarded over 41 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation. IR-2021-200 October 12 2021 WASHINGTON The Internal Revenue Service recently awarded over 41 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation. IR-2021-200 October 12 2021 WASHINGTON The Internal Revenue Service recently awarded over 41 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation. The 2022 Projected US. The 2022 Projected US. The 2022 Projected US. Tax Rates and Brackets Tables for Tax Year 2020. Tax Rates and Brackets Tables for Tax Year 2020. Tax Rates and Brackets Tables for Tax Year 2020.

The 2022 Projected US. The 2022 Projected US. The 2022 Projected US. Below are the official 2021 IRS tax brackets. Below are the official 2021 IRS tax brackets. Below are the official 2021 IRS tax brackets. Individual Income Tax Rate Brackets. Individual Income Tax Rate Brackets. Individual Income Tax Rate Brackets.

10 0 to 20550. 10 0 to 20550. 10 0 to 20550. For example the 10 percent tax bracket applies to income up to 9950 for single filers in 2021 tax brackets whereas it was 9700 for 2020. For example the 10 percent tax bracket applies to income up to 9950 for single filers in 2021 tax brackets whereas it was 9700 for 2020. For example the 10 percent tax bracket applies to income up to 9950 for single filers in 2021 tax brackets whereas it was 9700 for 2020. 22 83550 to 178150. 22 83550 to 178150. 22 83550 to 178150.

35 431900 to 647850. 35 431900 to 647850. 35 431900 to 647850. 10 0 to 10275. 10 0 to 10275. 10 0 to 10275. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors.

Gross income ceiling for corporations and partnerships to use the cash method of accounting which for 2022 is projected to remain 27000000. Gross income ceiling for corporations and partnerships to use the cash method of accounting which for 2022 is projected to remain 27000000. Gross income ceiling for corporations and partnerships to use the cash method of accounting which for 2022 is projected to remain 27000000. 32 340100 to 431900. 32 340100 to 431900. 32 340100 to 431900. Federal tax brackets 2022 chart. Federal tax brackets 2022 chart. Federal tax brackets 2022 chart.

24 178150 to 340100. 24 178150 to 340100. 24 178150 to 340100. Bloomberg Tax Accounting has issued its projections for 2022 federal income tax rates and tables which provides a detailed and comprehensive projection of inflation-adjusted amounts in the tax code. Bloomberg Tax Accounting has issued its projections for 2022 federal income tax rates and tables which provides a detailed and comprehensive projection of inflation-adjusted amounts in the tax code. Bloomberg Tax Accounting has issued its projections for 2022 federal income tax rates and tables which provides a detailed and comprehensive projection of inflation-adjusted amounts in the tax code. This year the IRS awarded grants to 34 TCE and 300 VITA applicants. This year the IRS awarded grants to 34 TCE and 300 VITA applicants. This year the IRS awarded grants to 34 TCE and 300 VITA applicants.

Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors. 24 178150 to 340100. 24 178150 to 340100. 24 178150 to 340100. 12 20550 to 83550. 12 20550 to 83550. 12 20550 to 83550.

Projected 2022 Tax Rate Bracket Income Ranges. Projected 2022 Tax Rate Bracket Income Ranges. Projected 2022 Tax Rate Bracket Income Ranges. Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. IRS Releases 2021 Tax Brackets. IRS Releases 2021 Tax Brackets. IRS Releases 2021 Tax Brackets.

If you are looking for 2022 Irs Income Tax Brackets you've come to the ideal location. We ve got 20 images about 2022 irs income tax brackets including images, pictures, photos, backgrounds, and more. In such webpage, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

25 Percent Corporate Income Tax Rate Details Analysis

Source Image @ taxfoundation.org

House Democrats Tax On Corporate Income Third Highest In Oecd

Source Image @ taxfoundation.org

Where S My Stimulus Check Get My Payment App Let S You Check Status How To Find Out Payment Schedule Budgeting Money

Source Image @ www.pinterest.com

Growing Your Tsp Retirement Benefits Institute

Source Image @ tr.pinterest.com